Bitcoin market on the rise: Whales accumulate BTC and technical indicators point towards a possible $100,000!

Bitcoin: Bullish Signal from Whales and Technical Indicators Bitcoin, the most famous cryptocurrency, has recently seen a rise that is regaining the trust of the so-called “whales” – large Bitcoin holders. These whales are starting to accumulate BTC again, which is interpreted as a bullish signal for the market. Technical indicators such as the Ichimoku cloud and the exponential moving averages (EMA) support the positive sentiment. Bitcoin Whale Holdings at Highest Level Since December 15th The number of Bitcoin wallets holding between 1,000 and 10,000 BTC increased from 1,980 on March 22nd to 1,991 on March 25th. This represents the highest level since December 15th...

Bitcoin market on the rise: Whales accumulate BTC and technical indicators point towards a possible $100,000!

Bitcoin: Bullish signal from whales and technical indicators

Bitcoin, the most famous cryptocurrency, has recently experienced a surge that is regaining the trust of the so-called “whales” – large Bitcoin holders. These whales are starting to accumulate BTC again, which is interpreted as a bullish signal for the market. Technical indicators such as the Ichimoku cloud and the exponential moving averages (EMA) support the positive sentiment.

Bitcoin whale holdings at highest level since December 15th

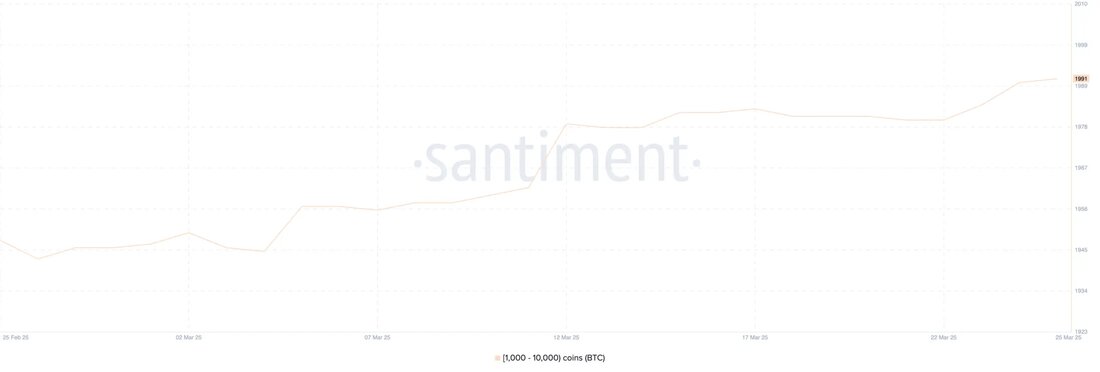

The number of Bitcoin wallets holding between 1,000 and 10,000 BTC increased from 1,980 on March 22nd to 1,991 on March 25th. This represents the highest level since December 15th. Although this increase is relatively modest, it still reflects renewed accumulation by large holders, after over three months of quiet activity.

Monitoring whale portfolios is of great importance as these significant players often influence the markets. Their patterns of accumulation or distribution can act as early warning signals of broader changes in sentiment or larger price movements. Whales are often considered “smart money”; Their increasing interest may therefore be an indicator of increased confidence in short-term market developments.

Bitcoin Ichimoku Cloud Shows Good Momentum

Bitcoin’s Ichimoku cloud chart shows a bullish structure. The price movements are well above the cloud, which is currently green and rising. The Tenkan-sen (blue) is positioned above the Kijun-sen (red), indicating continued near-term bullish momentum. However, both lines are showing signs of flattening, which could indicate possible consolidation.

The future cloud (Kumo) is wide and rising, indicating a solid supportive foundation and growing trend strength. The Chikou Span, the trailing line, is well positioned above past price action, further confirming the bullish sentiment. There could be sideways movement in the short term, but the entire Ichimoku setup remains bullish unless there is a break below the clouds.

Will the Bitcoin price rise back to the $100,000 mark in April?

Bitcoin's EMA lines appear to be lining up for a potential golden cross, which could signal the start of a new bullish phase. If this crossover occurs and Bitcoin price breaks the resistance at $88,807, it could lead to a move towards $92,928.

A strong continuation of the uptrend could help Bitcoin test the $96,503 and $99,472 levels, with the possibility of a breakout above $100,000 if momentum increases.

However, if Bitcoin fails to rise above $88,807 and experience a trend reversal, the price could fall back and test the support at $84,736. A break below this level could lead to further downside towards $81,162. If selling pressure continues, Bitcoin could even reach back to $79,970 and $76,644 and possibly fall below the $80,000 level.

Overall, the current developments surrounding Bitcoin offer both opportunities and risks. Investors should therefore carefully monitor market movements and technical indicators.

Suche

Suche

Mein Konto

Mein Konto